The Single Strategy To Use For Payment Solutions

Wiki Article

The Basic Principles Of Payment Solutions

Table of ContentsThe Best Strategy To Use For Credit Card ProcessingGetting My Comdata Payment Solutions To WorkRumored Buzz on Online Payment SolutionsSome Known Facts About First Data Merchant Services.Online Payment Solutions Can Be Fun For AnyoneThe Only Guide for Payment Solutions

Have you ever questioned what happens behind the scenes when an online settlement is made? If you are just starting with the service of e, Business and also online payments or if you are merely interested concerning the procedure it can be testing to browse the intricate terms used in the sector and understand what each actor does and also how.

A seller is any kind of individual or business that sells products or solutions. An e, Commerce merchant refers to an event who markets products or services via the Web.

You're probably wondering what an acquiring financial institution is well, it's a bank or economic institution that is a signed up member of a card network, such as Visa or Master, Card, as well as accepts (or acquires) purchases for sellers, on behalf of the debit and also bank card networks. We'll cover this in more information later in this article - payment hub.

The Best Guide To Ebpp

A for a details seller. This account number resembles various other distinct account numbers issued by a financial institution (like a checking account number), yet is particularly made use of by the seller to recognize itself as the owner of the deal details it sends out to the financial institution, in addition to the recipient of the funds from the deals.

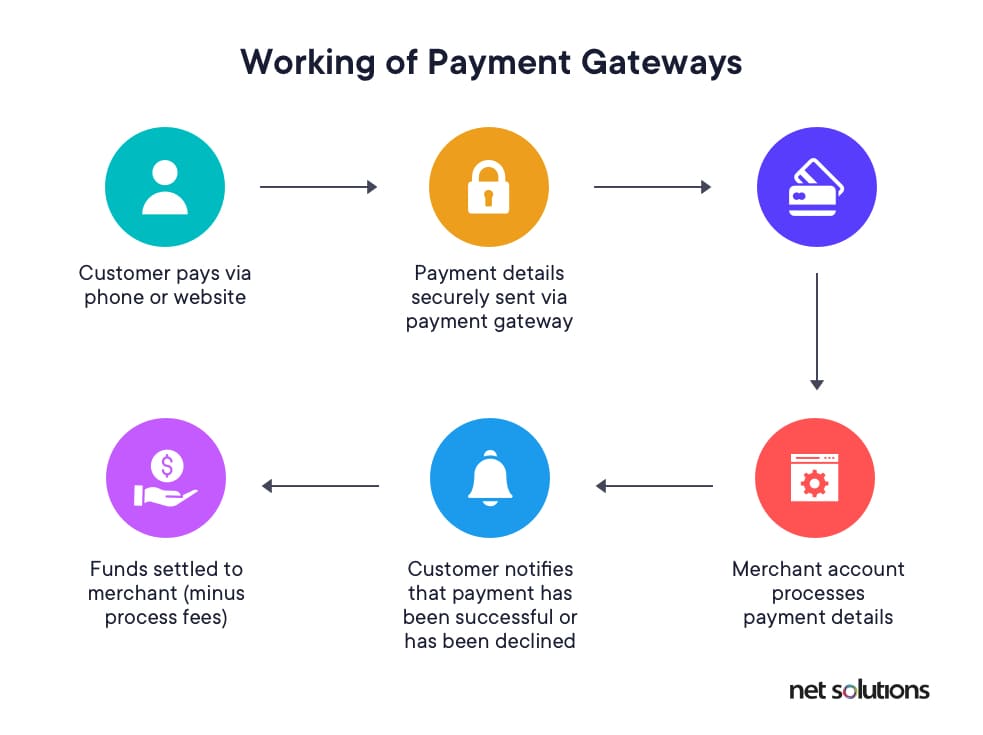

When the merchant has actually gotten a seller account, whenever a client acquisitions a thing with a credit score or debit card, the merchant submits the purchase transaction information to the payment cpu made use of by its obtaining financial institution by means of a settlement gateway. A settlement entrance is a software program that assists in the communication of deal info.

Credit Card Processing Things To Know Before You Get This

The (e. g. in the situation of American Express) or call the card's issuing bank for consent (in the case of Visa/Master, Card). An issuing bank is any type of bank or economic establishment that gives (or issues) credit history or debit cards, via card associations. Exactly how Does an Issuing Bank Job?An obtaining financial institution is a financial institution or banks that accepts debit or charge card purchases for a cardholder. Just how Does an Obtaining Bank tsys merchant services Work? Acquirers/Acquiring banks this website are registered participants of a card network, such as Master, Card or Visa, and also approve (or acquire) purchases in support of those debit and bank card networks, for a vendor (virtual terminal).

Whenever a cardholder makes use of a debit or bank card for a purchase, the getting financial institution will either approve or decrease the deals based upon the details the card network and releasing financial institution have on record about that card holder's account. Apart from taking care of transactions, an acquirer also presumes complete threat as well as duty associated with the deals it refines.

6 Easy Facts About Virtual Terminal Shown

The providing financial institution then connects the result (approved/declined) and also the reason for it back to the repayment cpu, which will subsequently relay it to the seller as well as buyer with the payment gateway. If the purchase is accepted, then the amount of the deal is subtracted from the card holder's account and also the cardholder is given a receipt.The next action is for the vendor to satisfy the order positioned by the consumer. After the seller has actually satisfied the order, the releasing bank will certainly get rid of the authorization on the customer's funds and also get ready for deal settlement with the seller's obtaining financial institution. Credit History Card Interchange is the websites process in which an acquirer or getting bank sends accepted card transactions in support of its sellers.

Excitement About Credit Card Processing Companies

The acquiring financial institution after that sends deal negotiation demands to the buyers' providing banks involved. When all consents have been made and also all authorizations gotten by the entailed parties, the releasing bank of the customer sends out funds to the seller's getting financial institution, by means of that financial institution's payment cpu.This is called a settlement pay or negotiation. For regular card purchases, even though the permission and also approval for order fulfillment take only seconds, the whole payment processing circuit in the background can occupy to 3 days to be completed. And there you have it exactly how the payments market functions, basically.

Learn around much more terms and also ideas around on-line repayment handling by reading this total guide.

Getting The Payeezy Gateway To Work

Also described as the cardholder's banks - credit card processing companies. An Acquirer is a Visa/ Master, Card Affiliated Financial institution or Bank/Processor alliance that remains in business of processing credit report card deals for businesses and is always Getting brand-new sellers. A merchant account has a variety of charges, some periodic, others billed on a per-item or percent basis.Report this wiki page